First, we’d like to sincerely thank you for considering us for your tax preparation and/or accounting needs. We know you had a lot of choices and we’re excited to have the opportunity to work with you.

At our firm, we streamline your tax preparation process with a blend of personal service, expert guidance and advanced technology. Whether you prefer in-person consultations or the convenience of virtual meetings, we accommodate your schedule and preference to ensure a seamless experience.

Our proactive, forward-thinking tax strategies, simplified and convenient process, and mantra that “your success is our success” provide not only peace of mind, but in many cases, significant savings and the ability to make changes going forward to help you keep more of your hard earned money!

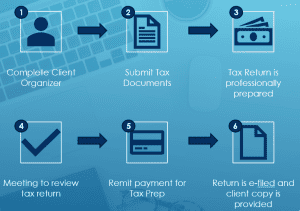

Our Process:

- Client Organizer via Secure Portal: To assist you in gathering and organizing your tax documents, we provide a client organizer through our secure client portal. This tool simplifies the process of collecting the necessary information, ensuring a comprehensive and accurate tax preparation.

- Secure Document Handling: For submitting your tax documents, we offer two secure methods. You can either upload your documents to our secure client portal, a safe and efficient way to transfer information, or you can drop off your documents at our office if that’s more convenient for you.

- Professional Tax Preparation: Your return is prepared by our tax professionals based on the information you provide, compared to your prior year return, reviewed and analyzed by our team for future tax savings opportunities

- Flexible Appointment Options: Choose between in-person or virtual appointments. Our virtual appointments are designed to be as interactive and informative as our in-office consultations, ensuring your comfort and convenience.

- Streamlined Payment Processing: After the completion of your tax preparation but before filing, we will issue an invoice detailing the services provided along with the total fee due. You can conveniently pay via our client portal, over the phone, or in office and we accept various forms of payment, including credit/debit cards, bank transfers, and online payment platforms. We also have the ability to have your tax prep fees deducted from your tax refund. Our aim is to accommodate your preferred method of payment.

- Electronic Filing: We use the IRS e-file system to submit your tax return, which is a fast, secure, and reliable filing method. E-filing also allows for a quicker turnaround on any potential refunds. After your return is e-filed, we upload a copy of the official client tax return documents to our secure client portal. This portal is a safe, encrypted platform where you can access your documents at any time. You’ll receive an email notification with instructions on how to securely access and download your documents from the portal. Our team is available to guide you through accessing the portal and to answer any questions you may have about your tax return.

Our goal is to make your tax preparation process as smooth and efficient as possible, providing expert guidance every step of the way. We’re committed to delivering top-tier tax services tailored to your unique needs.