Pass through entity tax is a state tax imposed on pass-through entities (S-Corps & Partnerships). A Pass-Through Entity Tax (PET) was primarily implemented to address the federal tax changes under the Tax Cuts and Jobs Act (TCJA) that limited state and local tax deductions for individuals. The PET is designed to help pass-through entity owners, such as members of LLCs or partners in partnerships, mitigate the impact of this limitation.

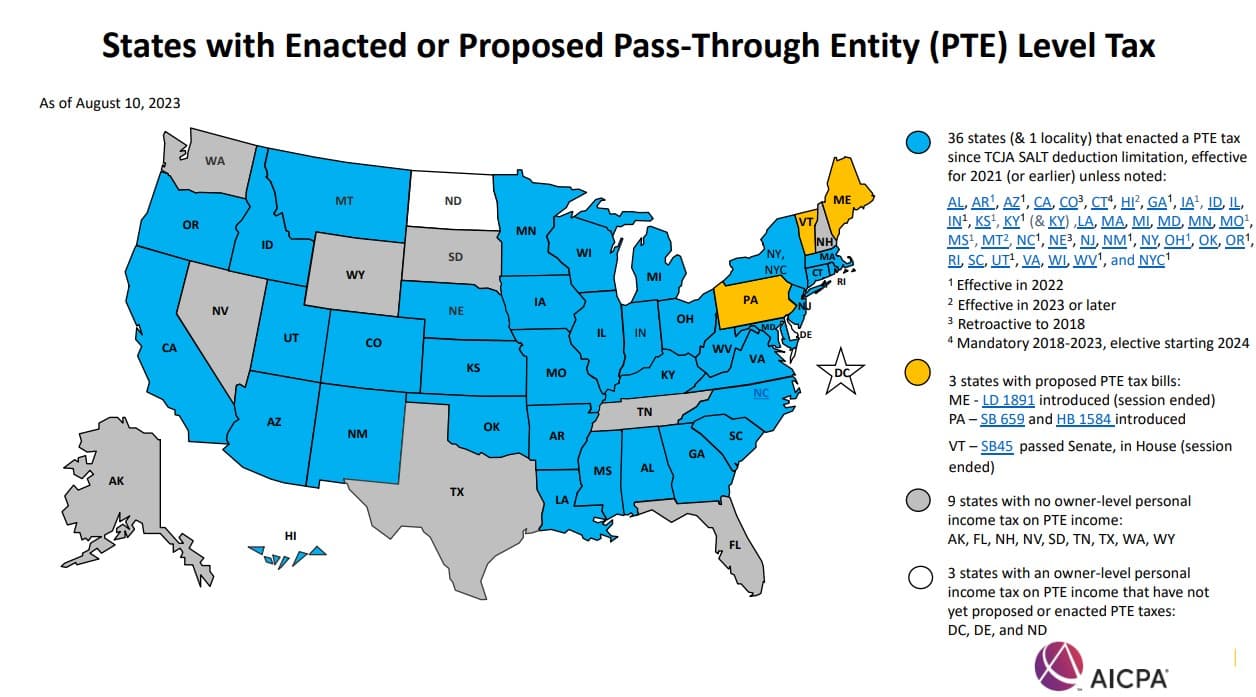

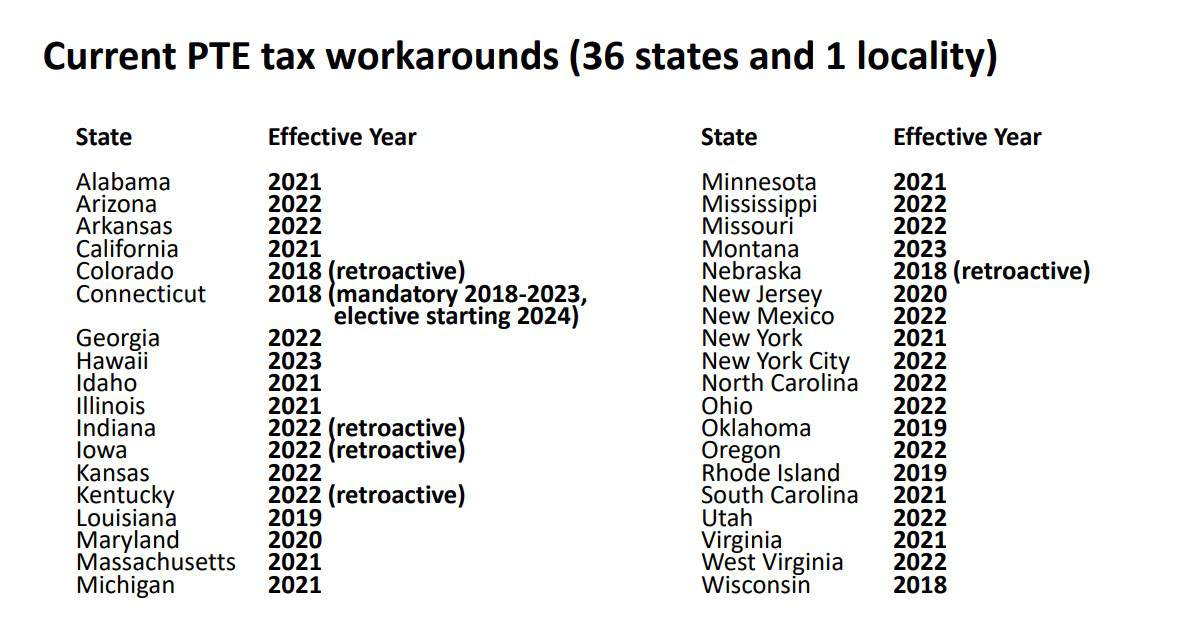

For a list of state’s that have pass-through entity tax, see the illustration below.

Here’s a simplified overview of how the Pass-Through Entity Tax (PET) works. Please note, in Connecticut you are automatically subject to PTE where in certain other states, you have to elect to be subject to PET.

1. **Taxation at the Entity Level:** Pass-through entities, such partnerships and S corporations, can elect to be subject to the PET. When they make this election, the entity itself pays the PET on its taxable income.

2. **Offset for Owners:** The owners or members of the pass-through entity receive a credit on their individual state income tax returns for their share of the PET paid by the entity. This credit effectively reduces their individual state income tax liability.

3. **Benefit to Owners:** By paying the PET at the entity level and receiving a credit at the individual level, pass-through entity owners can potentially reduce their overall state income tax liability compared to if they had paid tax on their share of the entity’s income at the individual level.

4. **Annual Filing:** Pass-through entities that choose to pay the PET must file an annual tax return with their state.