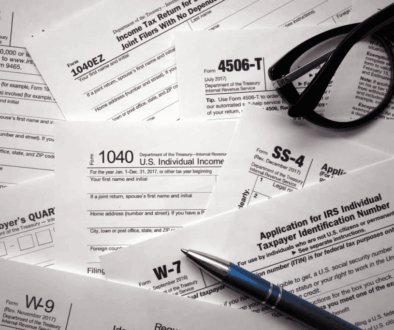

5 Tips to Be Prepared for Tax Season

Tax season can be overwhelming, but with a little preparation, you can reduce stress and maximize your tax savings. Here are five essential tips to help you get ahead of the game:

1. Organize Your Documents Early

Gather all necessary documents such as W-2s, 1099s, investment statements, and receipts for deductible expenses. Use a folder or digital tool to keep everything in one place. The earlier you start, the less likely you’ll miss something important.

2. Maximize Tax Deductions and Credits

Review deductions and credits available for your situation. For example, small business owners can deduct office expenses, vehicle use, and more. Parents might qualify for child tax credits or education-related deductions. We will thoroughly review all of this as part of your tax return!

3. Leverage Technology

Take advantage of software and apps to streamline the process. Many tools can help track expenses throughout the year, making it easier to report them accurately during tax season. We utilize a secure client portal as well to facilitate this whole process.

4. Plan for Self-Employment or Gig Work

If you’re self-employed or earn side income, set aside money for taxes. Remember, freelancers may also need to pay quarterly estimated taxes. Keep detailed records of income and expenses to simplify filing and avoid penalties.

5. Work with a Tax Professional

Our team of tax and accounting professionals will help you navigate tax laws, find additional savings, and avoid costly mistakes. We’ll ensure that you’re compliant while providing strategic advice to optimize your financial situation.

By taking these steps, you can approach tax season with confidence and efficiency.

Ready to Get Started?

Book your appointment today and let us help you keep more of your hard earned money!